Cryptocurrency mining is the process of verifying and adding new transactions to a blockchain, a decentralized digital ledger. It involves the use of high-powered computers to solve complex mathematical equations and, in turn, receive a reward in the form of cryptocurrency tokens. While cryptocurrency mining has gained immense popularity in recent years, its environmental impact cannot be ignored. Continue reading “The Environmental Impact of Cryptocurrency Mining”

Current State of Cryptocurrency Regulation and its Impact on the Industry

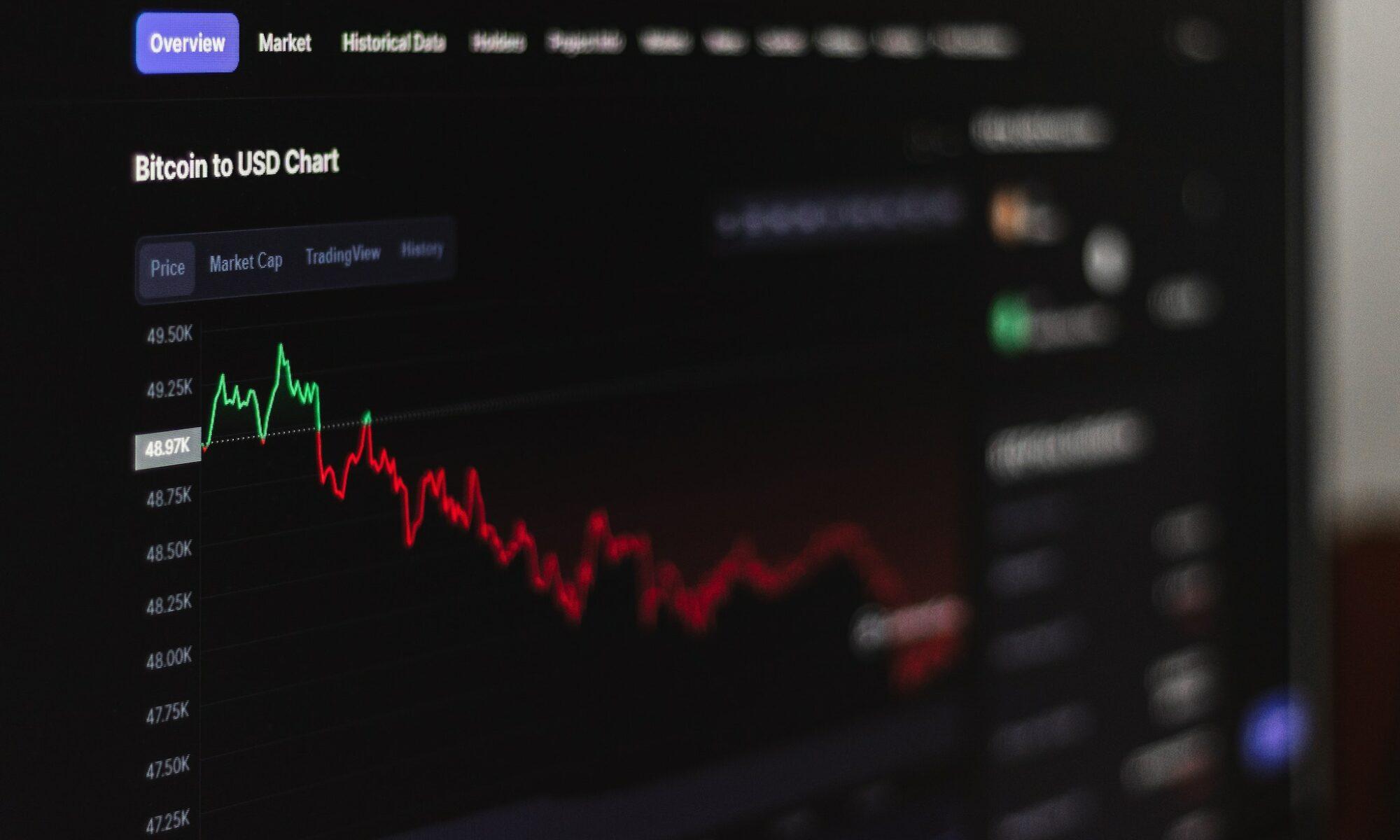

It’s a truth as unalterable as the blockchain: the universe of cryptocurrency has undergone a titanic evolution since Bitcoin’s seminal debut in 2009. Galaxies away from its humble beginnings, the market cap for cryptocurrencies rocketed towards a mind-boggling figure of almost $2 trillion in 2021. A staggeringly impressive feat, yet, not without its contentious underbelly. Rising alongside these monumental heights is an omnipresent specter – the tangled thicket of regulatory concerns.

As we embark on this journey, let’s navigate the labyrinthine intricacies of cryptocurrency regulation and its reverberating shockwaves across the industry’s landscape.

A Primer on the Enigma of Cryptocurrency Regulation

The allure of cryptocurrency lies in its unabashed rebellion against traditional norms. No government backing it, no financial institution dictating its rhythm. Instead, it breathes and thrives within the anarchic expanse of a peer-to-peer network, eluding the grasp of conventional banking regulations. But this unbridled freedom comes with its share of Pandora’s Box: money laundering, tax evasion, fraud. Naturally, the governmental watchdogs and regulatory overseers responded with a call-to-arms, forging regulations to counter these disquieting shadows.

Cryptocurrency Regulation: A Global Patchwork of Approaches

The globe-spanning embrace of cryptocurrency has birthed a kaleidoscopic array of regulatory landscapes, as diverse as the countries they belong to. Some nations welcomed it with open arms, delineating clear rules, while others vehemently repudiated its existence. Here’s an illustrative cross-section of how various countries are dancing with the enigmatic partner that is cryptocurrency:

United States:

A proverbial Rubik’s cube, the US treats cryptocurrency regulation as a complex puzzle. Multiple players on the chessboard, namely, the SEC, CFTC, and IRS, each castling different aspects of cryptocurrency regulation.

China:

A stern disciplinarian, China swung the ban-hammer on cryptocurrency transactions in 2021. Additionally, a decisive blow to cryptocurrency mining resulted in a shrinking share of China’s global cryptocurrency mining dominance.

Europe:

A smorgasbord of attitudes greet you in Europe. With nations like Germany and France outlining clear rules, juxtaposed against others playing a more passive spectator, it is an intriguing mix.

Japan:

An avant-garde pioneer, Japan gave Bitcoin the legal nod of approval in 2017. Simultaneously, it paved the way for robust regulations governing cryptocurrency exchanges.

The Ripple Effect of Cryptocurrency Regulation on the Industry

The effects of regulatory measures on cryptocurrency are a complex jigsaw puzzle. On the brighter side, regulation offers a cloak of legitimacy and clarity, potentially boosting adoption rates and inviting investments. Yet, this very mechanism could smother the lifeblood of the industry – innovation.

Legitimacy and Clarity:

A clear regulatory framework casts away the menacing clouds of fraud and money laundering, fostering increased trust in the industry. It’s a catalyst for greater adoption and investments in cryptocurrencies.

Innovation’s Strangulation:

Yet, an overzealous regulatory straitjacket might throttle the innovative spirit that drives the industry. The stark example of China’s ban on cryptocurrency transactions has led to a plummet in the country’s share of the global cryptocurrency mining market – a blow to an erstwhile giant.

As the age of cryptocurrency burgeons, so does the need for a fine balance in its regulation. Countries across the globe must carve out a regulatory framework that can elegantly straddle the tightrope of innovation and security. The path forward is fraught with myriad challenges and questions, many of which we address in our FAQ section. The importance of cryptocurrency regulation, the future outlook, its effects on investors, and challenges associated with regulation – all are crucial points of consideration in this evolving landscape. The goal remains to stay informed, vigilant, and proactive as we continue to shape and understand the world of cryptocurrency regulation.

Building a Cryptocurrency Mining Rig: A Beginner’s Guide

Plunge into the cryptic labyrinth of cryptocurrency mining! It’s a journey of unraveling complex mathematical knots that secure the colossal blockchain network. A robust chariot for this odyssey? Cryptocurrency mining rigs—sturdy computers—endowed with herculean strength to decrypt and confirm transactions. Continue reading “Building a Cryptocurrency Mining Rig: A Beginner’s Guide”

Top Privacy Coins and Their Use Cases

Cryptocurrency, this swashbuckling disruptor of traditional financial systems, has rewritten the book on transactional processes. The rise of this digitally dominant payment method, whilst pioneering, has flung open the Pandora’s box of privacy concerns, stirring unease amongst the global populace. Like a knight in shining armor, privacy coins have emerged, promising to guard our online transactions from prying eyes. In the labyrinthine world of digital currencies, let’s navigate through the hallways of top-tier privacy coins and their applications. Continue reading “Top Privacy Coins and Their Use Cases”

A Comprehensive Guide to Ethereum

Cryptocurrencies have emerged as a highly sought-after subject matter in recent years, with Bitcoin garnering significant recognition. Nevertheless, an abundance of alternative digital currencies exists, and one of the noteworthy contenders is Ethereum. In the comprehensive exposition that ensues, we shall delve into every intricate detail you need to acquaint yourself with regarding Ethereum, spanning from its technological aspects to its prospective trajectory. Continue reading “A Comprehensive Guide to Ethereum”

Staking Cryptocurrencies: Passive Income Opportunities

Unveiling the Mysteries: The Astonishing World of Cryptocurrency Staking

Embarking on a riveting voyage through the realms of digital finance, we discover the burgeoning fascination with cryptocurrencies as a lucrative investment avenue. The quest for generating passive income from these virtual treasures has ensnared the minds of countless investors. Amidst this whirlwind, one method reigns supreme: the enigmatic practice of staking. Brace yourself for an enthralling exploration into the depths of staking, an artful dance of holding digital currencies in wallets to underpin networks and reap the bountiful rewards that await. Continue reading “Staking Cryptocurrencies: Passive Income Opportunities”

A Guide to Investing in Cryptocurrencies: Everything You Need to Know

Faced with the tantalizing world of digital currencies and unsure where to plant your initial steps? Fear not, gentle reader. This missive, swirling with complexity, yet undulating with delightful simplicity, aims to lay bare the enigmatic maze that is cryptocurrency investment. Continue reading “A Guide to Investing in Cryptocurrencies: Everything You Need to Know”

The Impact of Cryptocurrency on the Global Economy

Bafflingly, the nebulous world of cryptocurrency remains a Pandora’s box, provoking a rich tapestry of fascination and apprehension, while drawing in investors, global policy wonks, and economists into its mysterious vortex. It’s a late-2000s brainchild whose universal embrace is more a thing of the recent past. Let’s delve into the labyrinth, unraveling the profound impact of this digitized phantom on the world’s economic pulse. Continue reading “The Impact of Cryptocurrency on the Global Economy”

Understanding Initial Coin Offerings (ICOs)

Venturing into the labyrinth of Initial Coin Offerings—ICOs, as they’re colloquially referred, it’s akin to entering an adventurous terrain; the air buzzes with innovation, and with it, a chance for startups to chart their future. Enthralling as the ease of access and diminished entry barriers might be, danger lurks in the possibility of risk, a facet of ICOs we must demystify. Continue reading “Understanding Initial Coin Offerings (ICOs)”

How to Store Your Cryptocurrency Securely

The rise of cryptocurrencies in the global financial arena, abrupt yet tenacious, is an event of such magnitude it leaves many bewildered. As 2021 came to a close, an astonishing revelation: the combined worth of all cryptocurrencies had barreled past the $2 trillion threshold. Individuals from all walks of life, beguiled by the aura of virtual currencies, plunged headlong into this new investment frontier. Mastering the nuances of safeguarding these digital assets? Not just a necessity, but an art in its own right. Continue reading “How to Store Your Cryptocurrency Securely”