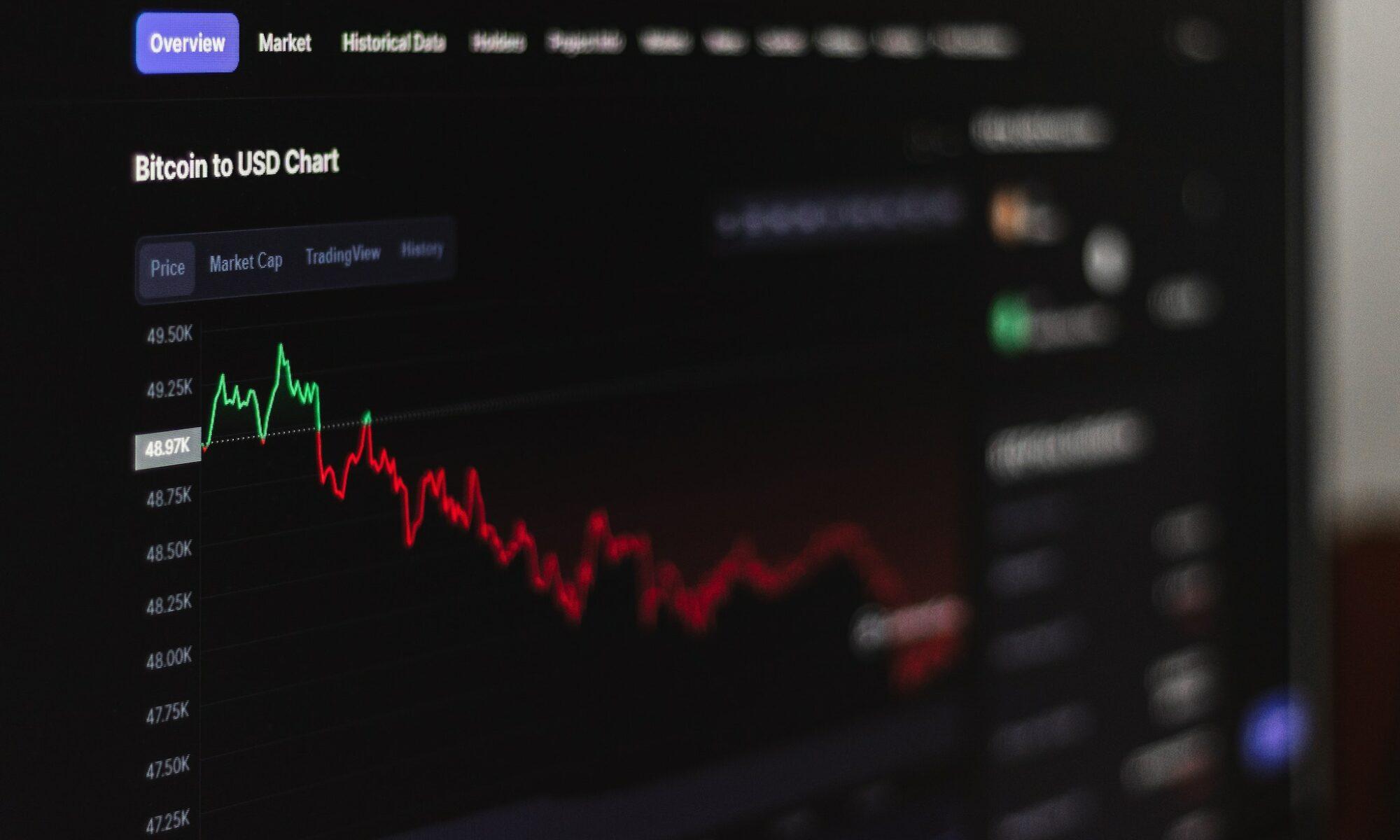

Let me take you on a journey through the intriguing world of cryptocurrencies. Their birth, metamorphosis, and relentless evolution have astounded the financial sector. You’re probably aware of Bitcoin, Ethereum, or Litecoin – these digital currencies that have been making headlines, haven’t you? The thing about these cryptocurrencies though is that they’re temperamental. They have highs, they have lows, and they oscillate like a turbulent sea. This instability can unsettle investors and traders who are in the game for the long haul.

But then comes the superhero of the crypto realm – the Stablecoin. These entities offer solidity amid the crypto storm. Think of them as the safe harbors in the tumultuous sea of the crypto market. Today, we’re setting sail into these calming waters, exploring how Stablecoins are influencing the crypto sphere and the potential revolution they herald in our transactional systems.

Stablecoins, by design, aspire for stability. To ensure this, they typically tether their value to tangible assets in the real world, such as the mighty dollar, lustrous gold, or even other cryptos. There are three distinct breeds of Stablecoins roaming the crypto savannah:

Fiat-collateralized Stablecoins – backed by traditional currencies, think of the dollar, the euro, or the yen. Central authorities issue these Stablecoins, maintaining reserves of the collateral in a bank vault somewhere. Known denizens of this category include the Tether (USDT), the USD Coin (USDC), and TrueUSD (TUSD).

Crypto-collateralized Stablecoins – these are propped up by other digital currencies, usually confined in a smart contract. They mandate over-collateralization, ensuring the underlying asset’s value always trumps the Stablecoin’s worth. Representative members include MakerDAO’s DAI, BitShares’ BitUSD, and Havven’s nUSD.

Non-collateralized Stablecoins – or algorithmic Stablecoins, employ intricate algorithms to ensure stability sans collateral. This breed thrives on a system of incentives and penalties, pegging their value to the underlying asset. Among their ranks, you’ll find Basis, Fragments, and Ampleforth.

The beauty of Stablecoins lies in their advantages. They offer stability, a bastion against the capriciousness of the crypto market. They are quick and efficient, with minor fees and near-instantaneous settlements – excellent for remittances and cross-border payments. Plus, transaction fees are significantly lower than traditional methods. Stablecoins offer global accessibility, cutting across geographical or financial barriers. They present a borderless payment solution, appealing for international transactions.

The use cases for Stablecoins are manifold. Traders utilize them as safety buoys in times of turbulent volatility. Stablecoins are brilliant for remittances, providing a fast and economical way to transfer money across borders. They’re the linchpin of decentralized finance (DeFi), enabling users to avail of a variety of financial services, sans intermediaries or traditional banking entities. Lending, borrowing, and trading in DeFi are critically dependent on Stablecoins.

However, like every superhero, Stablecoins have their Achilles heel. They face regulatory scrutiny, being viewed as potential disruptors of traditional banking systems. The fluctuating value of the collateral for crypto-backed Stablecoins poses another challenge. A sudden drop can lead to under-collateralization, resulting in a potential collapse of the Stablecoin’s value. Lastly, concerns around centralization and control also plague Stablecoins, as many are issued by central authorities, somewhat contradicting blockchain’s decentralization ethos.

Regardless of the hurdles, Stablecoins hold a promising future. The crypto ecosystem continues to mature, unveiling new use cases for Stablecoins. We can anticipate increased demand, sparking the evolution of innovative Stablecoin solutions.

In conclusion, Stablecoins stand as the beacon of stability in the volatile ocean of the crypto world. They bring several advantages to the table over traditional financial systems – stability, speed, affordability, and worldwide access. Simultaneously, challenges such as regulatory issues, collateral risks, and centralization concerns need to be addressed. Nevertheless, the future is ablaze with potential for Stablecoins, promising substantial adoption and evolution in the years ahead.

To answer your burning queries:

Most popular Stablecoins? Tether (USDT), USD Coin (USDC), and Dai (DAI).

How do Stablecoins maintain their peg? Through collateralization, algorithms, and market forces.

Are Stablecoins immune to market volatility? They’re designed to minimize volatility, but they’re not totally immune.

Benefits for holders? Stablecoins offer a stable store of value, allowing holders to transact without fretting over market instability.

Can they replace traditional currencies? While they offer substantial potential, complete replacement is improbable.

While they do possess remarkable advantages over traditional financial systems, Stablecoins also encounter several challenges. Furthermore, their acceptance is yet to gain widespread recognition, limiting their practicality for everyday transactions. Nevertheless, as the crypto world evolves and Stablecoins gain more traction, they could potentially emerge as a serious contender to traditional currencies.